Tax Responsibilities When It Comes to Starting a Business

Small business owners have a variety of tax responsibilities. The IRS knows that understanding and meeting tax obligations is vital to the success of all businesses, especially a new one. IRS.gov has the resources and information to help people through the process of starting a new business.

Here are some tips for new entrepreneurs:

- Sole proprietorship

- Partnership

- Corporation

- S Corporation

- Limited Liability Company

Choose a business structure

The form of business determines which income tax return a business taxpayer needs to file. The most common business structures are:

- Sole proprietorship: An unincorporated business owned by an individual. There's no distinction between the taxpayer and their business.

- Partnership: An unincorporated business with ownership shared between two or more people.

- Corporation: Also known as a C corporation. It's a separate entity owned by shareholders.

- S Corporation: A corporation that elects to pass corporate income, losses, deductions and credits through to the shareholders.

- Limited Liability Company: A business structure allowed by state statute.

Choose a tax year.

A tax year is an annual accounting period for keeping records and reporting income and expenses. A new business owner must choose either:

- Calendar year: 12 consecutive months beginning January 1 and ending December 31.

- Fiscal year: 12 consecutive months ending on the last day of any month except December.

Apply for an employer identification number.

An EIN is also called a federal tax identification number. It's used to identify a business. Most businesses need one of these numbers. It's important for a business with an EIN to keep the business mailing address, location and responsible party up to date. IRS regulations require EIN holders to report changes in the responsible party within 60 days. They do this by completing Form 8822-B, Change of Address or Responsible Party and mailing it to the address on the form.

Have all employees complete these forms:

Form I-9, Employment Eligibility Verification U.S. Citizenship and Immigration Services

Form W-4 Employee's Withholding Allowance Certificate

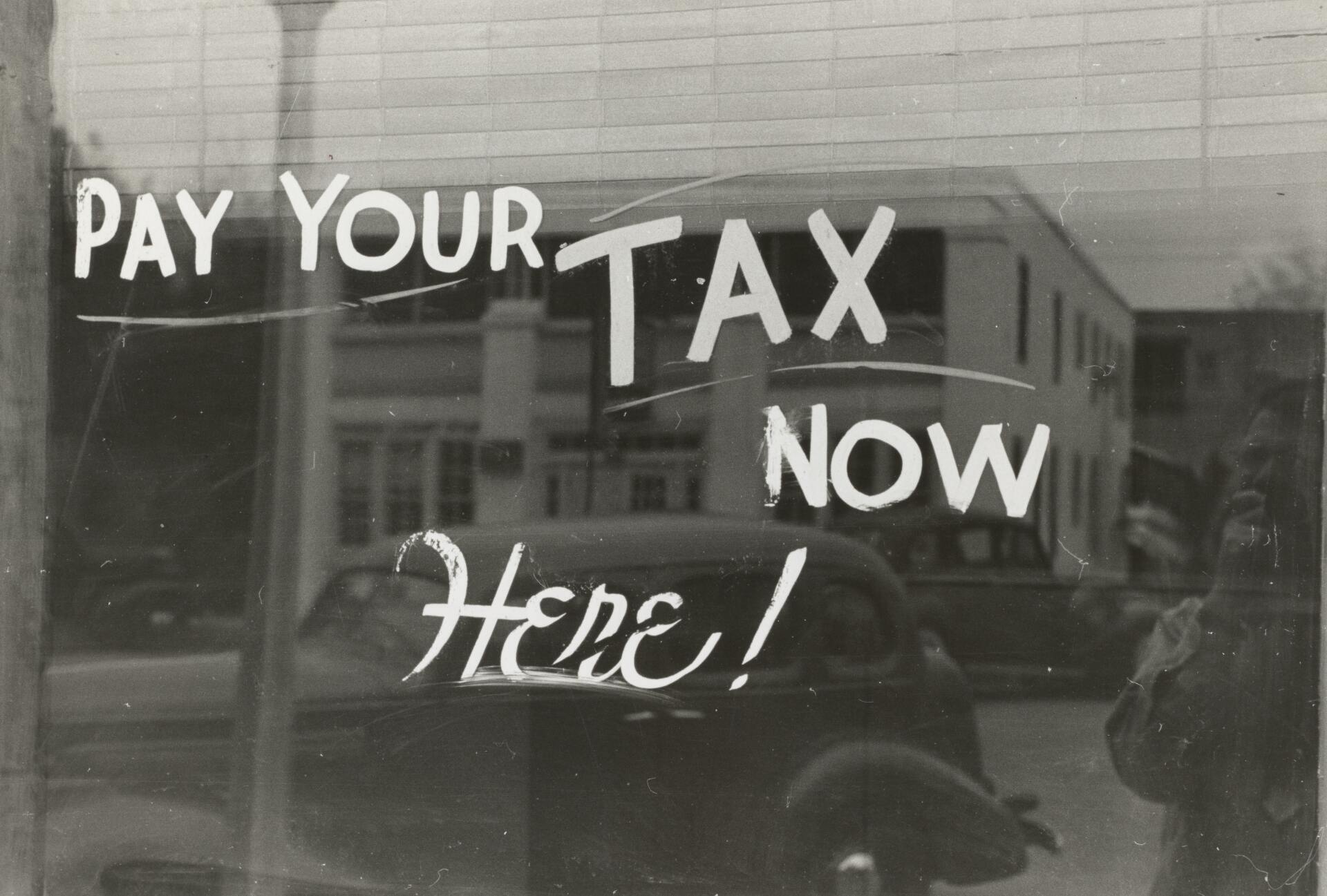

Pay business taxes.

The form of business determines what taxes must be paid and how to pay them.

How can we help you?

Need a professional with a wide range of knowledge in such tax-related subjects as income, estate, gift, payroll, levies, returns, inheritance, non-profit and

retirement taxes?

Call us! We are Tax Specialists serving our clients since 2012

Ana Echeverri & Associates at (407) 601-3157

We will be happy to assist you.

Our office hours are Monday thru Friday, from 9 A.M. to 5 P.M

Certified QuickBooks ProAdvisor offering Consulting

and Training Services

https://www.anaecheverriassociates.com

#accounting #orlandoFL #accountingFlorida #TaxesFlorida

#tax #accountingservices #taxrefund #enrolledagent

#CertifiedQuickBooksProAdvisor

Ana Echeverri

Certified QuickBooks ProAdvisor

Ana can help you set up and manage your QuickBooks online and on desktop. Having a streamlined chart of accounts and strategy for accounting will help you understand your company's ins and outs.