By Ana Echeverri

•

December 5, 2024

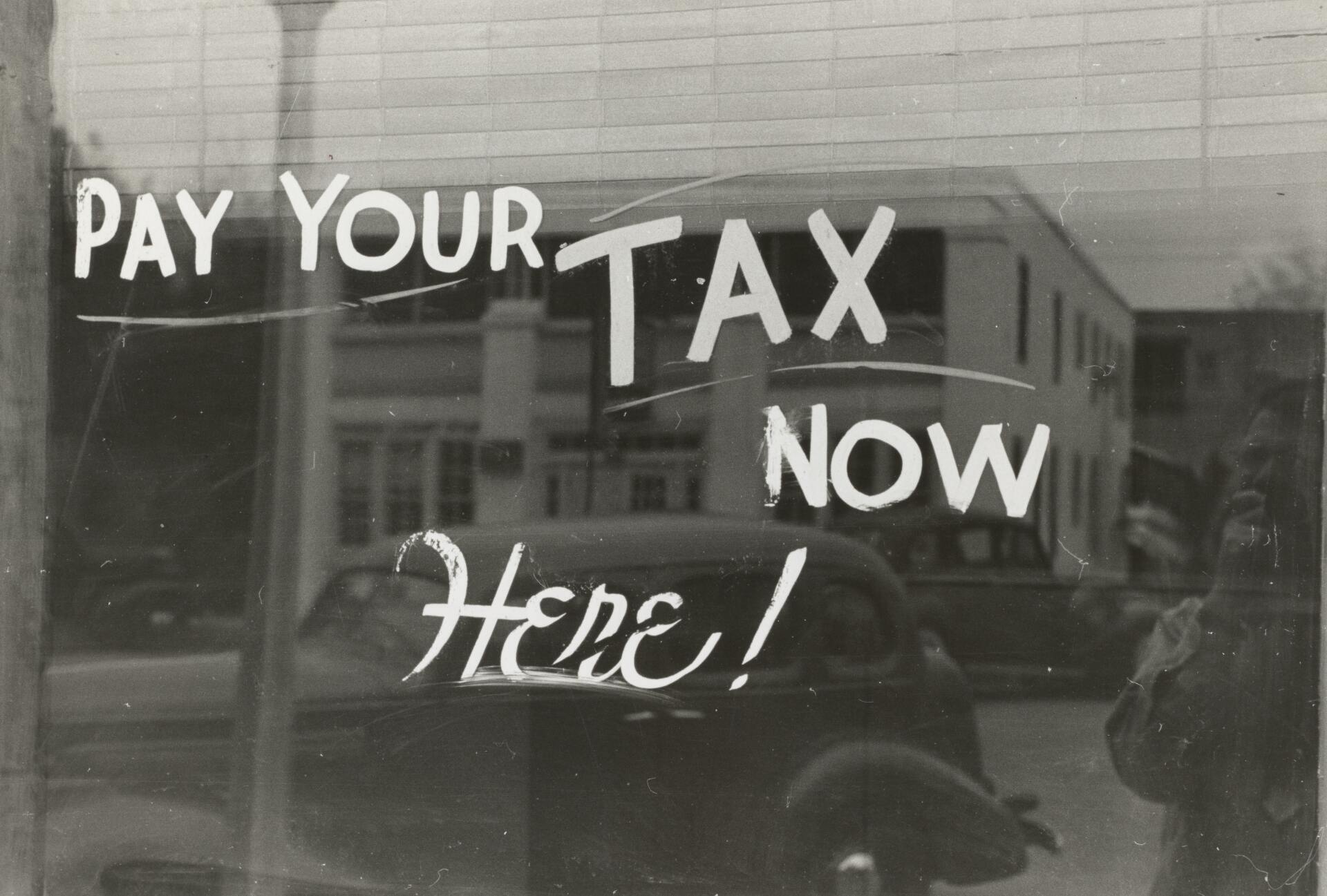

Are you ready to maximize your tax refund this year? 🏦💰 It’s time to get money-savvy and make the most of tax season! Here are some tips to help you claim every dollar you’re entitled to: . 1. Organize Your Documents Early Keep track of receipts, tax forms (W-2, 1099, etc.), and deductions throughout the year. A little preparation goes a long way in reducing stress and uncovering savings. . 2. Maximize Your Deductions Did you know that job-related expenses, medical bills, and charitable donations might qualify as deductions? Itemizing could unlock hidden savings that the standard deduction might overlook. . 3. Don’t Forget About Tax Credits Credits like the Earned Income Tax Credit (EITC), Child Tax Credit, and education-related credits (like the American Opportunity Credit) can significantly increase your refund. These credits often provide dollar-for-dollar savings. . 4. Contribute to Your Retirement Account Contributions to an IRA or 401(k) not only secure your future but also offer immediate tax benefits. Plus, some contributions might be deductible even after December 31! . 5. File Early Filing early reduces the chance of tax fraud and helps you receive your refund faster. Don’t procrastinate; the IRS starts processing returns in January. . 6. Double-Check Everything Simple mistakes like incorrect Social Security numbers or missed signatures can delay your refund. Review your return carefully before submitting it. . Remember, every dollar counts! A little effort now can lead to a bigger refund later. . Stay smart with your taxes! Reach out to us today and experience the difference of working with seasoned professionals! . Office #: (407) 601-3157 Off. hours: Monday through Friday, from 9 A.M. to 5 P.M. Email address: Ana@AnaEcheverriAssociates.com . Website: https://www.anaecheverriassociates.com/ . >>> [HABLAMOS ESPAÑOL] <<< . #OrganizeYourTaxes #SafeTaxDocuments #TaxSeason2023 #EarlyTaxFiling #TaxRefundSeason #FinancialPlanning #TaxPreparation #IncomeTaxTips #EstimatedTax #SmallBusiness #TaxTips #SmallBusiness #TaxDeductions