A payroll tax is a tax that an employer withholds from an employee’s salary and pays on behalf of his employees.

In the United States, the three primary line items deducted from paychecks in the United States are:

1. Social Security

2. Medicare

3. Income taxes.

Deducted payroll taxes are likely to be itemized on an employee’s pay stub. As of 2018, the Social Security tax is 12.4% on wages up to $128,400, and the Medicare tax is 2.9% on all wages. The employee and the employer share this tax burden equally.

Therefore, the employee and the employer each pay 6.2% for Social Security and 1.45% for Medicare taxes. When wages exceed $200,000, an additional 0.9% Medicare tax withholding applies to the employee only.

Self-employed individuals, including contractors, freelance writers, musicians, and small business owners also pay their version of payroll taxes.

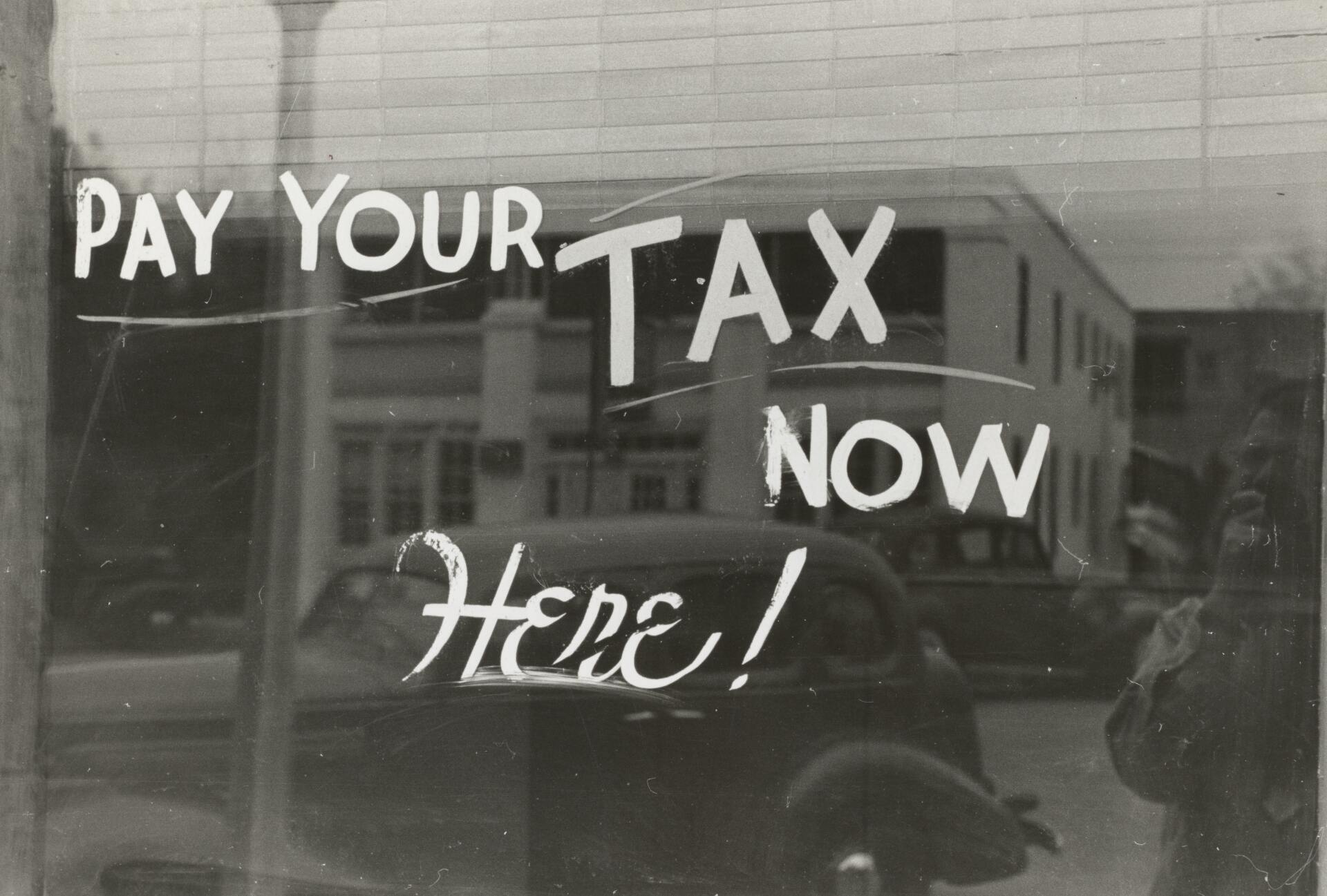

PENALTY: Failure to timely and properly pay federal payroll taxes results in an automatic penalty of 2% to 10%

Are you an employer or Self-employed? We can help you with Payroll Taxes. Call us and schedule an appointment.

#payrolltax #payrollservices #employer #selfemployed

Ana Echeverri

Certified QuickBooks ProAdvisor

Ana can help you set up and manage your QuickBooks online and on desktop. Having a streamlined chart of accounts and strategy for accounting will help you understand your company's ins and outs.