There are now many thousands of sharing economy platforms operating in almost every sector and activity around the world. Sharing-economy platforms that allow you to access almost anything, from a bicycle to a pet, when you’d like it, rather than owning it outright

The sharing economy enables individuals to monetize assets that are not being fully utilized. Underutilized assets range from large goods, such as cars and houses, to products such as tools, toys, and clothing

The sharing economy is an economic model based on: own much less and share much more. This model allows us to acquire, provide or share access to goods and services facilitated by a community-based online platform.

There are interesting examples of companies using this new economy:

Freelancing — Sites like TaskRabbit, Care.com and Upwork

Coworking — WeWork

Car sharing — Services like Lyft and Uber

Peer-to-Peer lending — Lending Club

Fashion — Sites like Poshmark and threadUP

Sharing resources — Allow people to borrow resources — like tools and kitchen appliances.

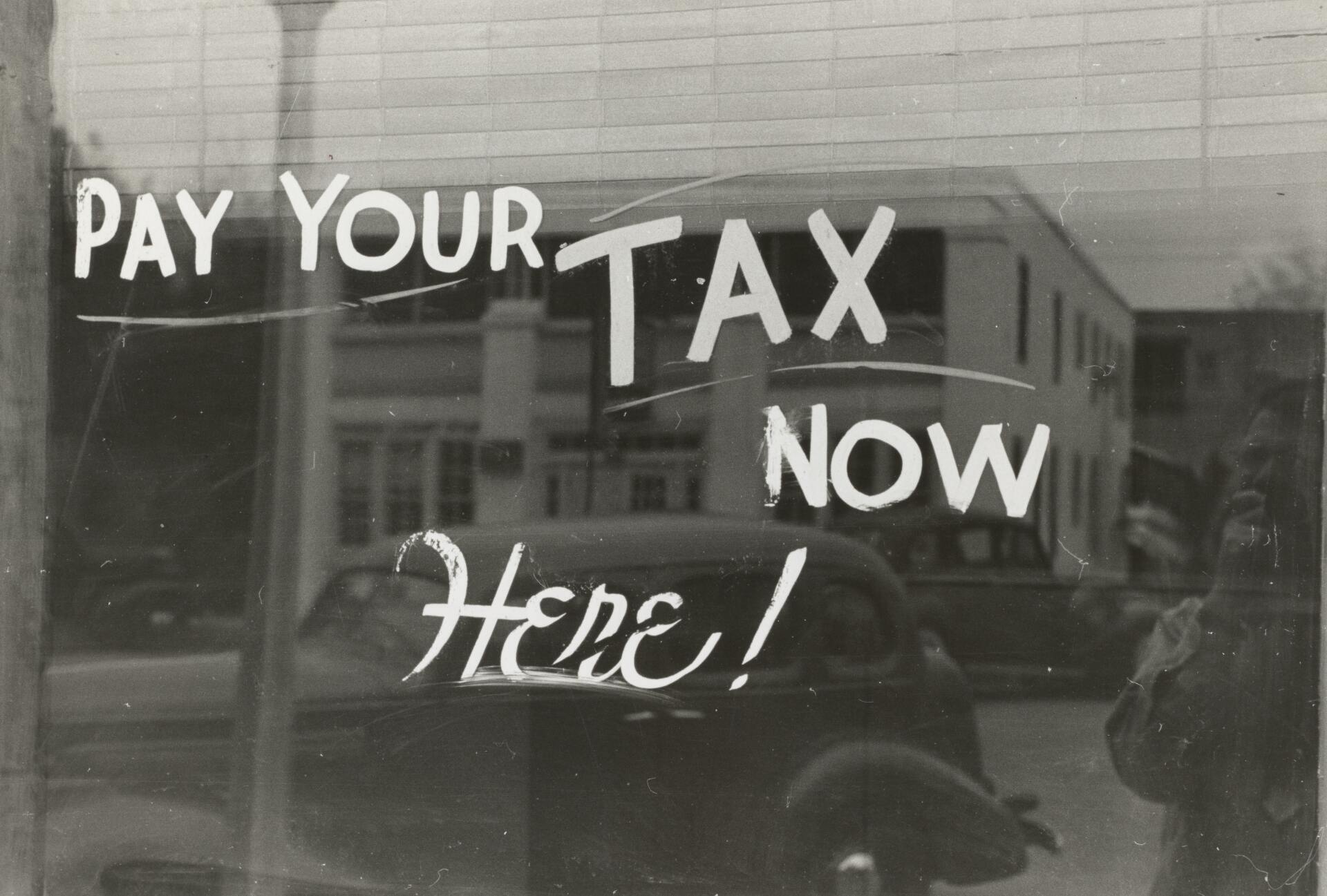

Why is so important this concept to us? It´s very simple: the income is taxable.

If you earn more than $400, self-employment tax obligations are not optional.

It’s a good idea to check upfront if you’re required to make quarterly payments because failing to do so when you should have can result in fines and penalties. Don´t procrastinate, you are on time to do it in the right way. Call me (407)601-3157

Ana Echeverri

Certified QuickBooks ProAdvisor

Ana can help you set up and manage your QuickBooks online and on desktop. Having a streamlined chart of accounts and strategy for accounting will help you understand your company's ins and outs.