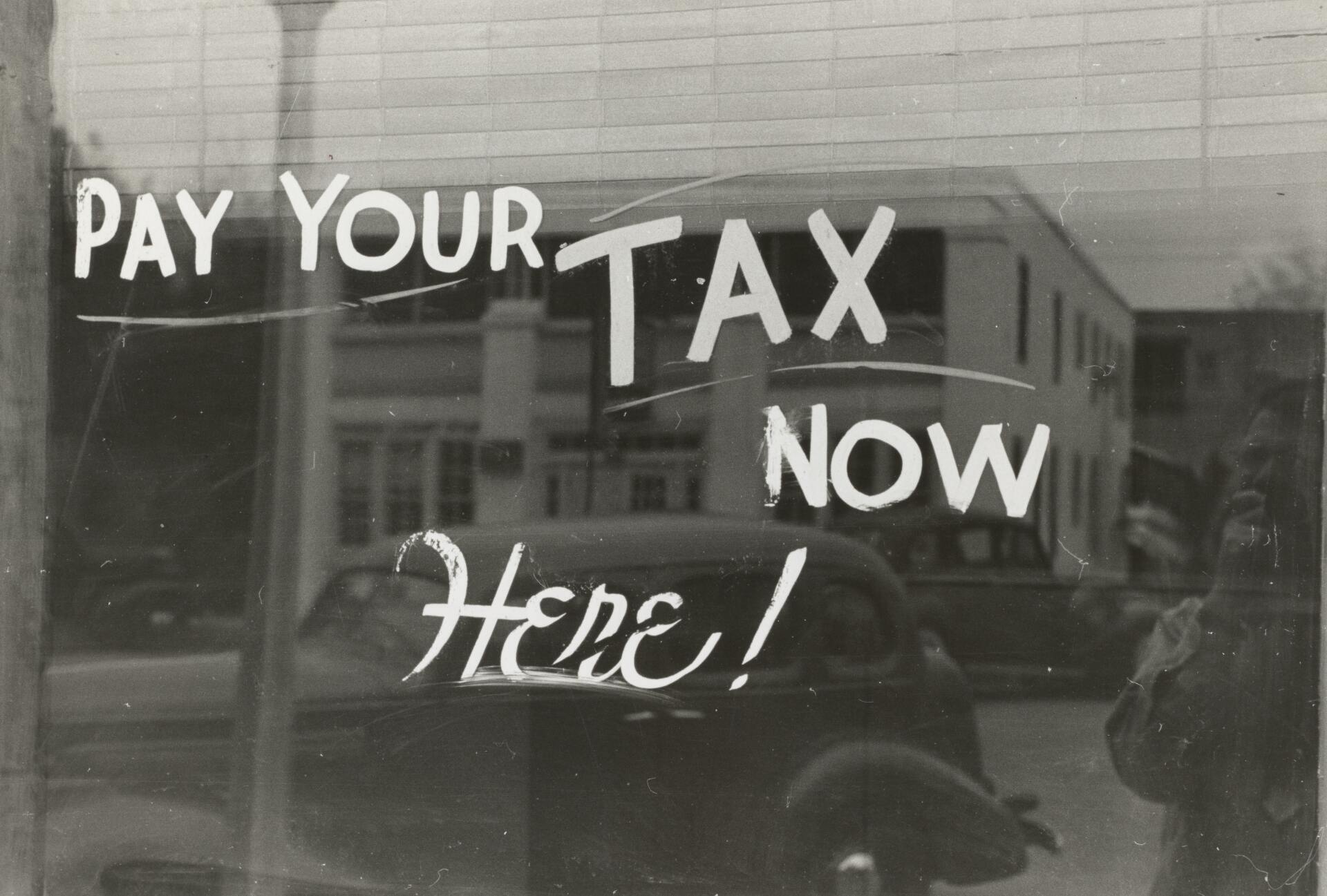

2024 tax filing season starts as IRS begins accepting tax returns today.

2024 tax filing season is on its way.

The IRS has begun to accept tax returns as of January 29, 2024.

WASHINGTON — The Internal Revenue Service successfully opened the 2024 tax season today by accepting and processing federal individual tax returns as the agency continues focusing on expanding options to help taxpayers.

.

The IRS expects more than 146 million individual tax returns for 2023 to be filed this filing season, with a deadline of April 15, 2024.

.

With the start of the 2024 filing season, the IRS will be extending service hours in nearly 250 Taxpayer Assistance Centers (TACs) nationwide, providing additional help to people. The IRS will also be working to continue improving its phone service and expanding online tools.

.

The “Where’s My Refund?” tool on IRS.gov will add more details for taxpayers checking on the status of their tax refund.

.

Building off the success of the 2023 tax season, which saw significant improvements following the passage of the Inflation Reduction Act, the 2024 filing season will continue reflecting the focus on improving services to taxpayers.

.

The IRS reminds taxpayers the deadline to file a 2023 tax return and pay any tax owed is Monday, April 15, 2024. Taxpayers living in Maine or Massachusetts have until April 17, 2024, due to the Patriot’s Day and Emancipation Day holidays. A taxpayer residing in a federally declared disaster area may have additional time to file.

.

Reach out to us today and experience the difference of working with seasoned professionals!

.

Office #: (407) 601-3157

Off. hours: Monday through Friday, from 9 A.M. to 5 P.M.

Email address:

Ana@AnaEcheverriAssociates.com

.

Website: https://www.anaecheverriassociates.com/

.

>>> [HABLAMOS ESPAÑOL] <<<

.

#TaxTimeTips #OrganizeYourTaxes #TaxFilingBasics #DeadlineAwareness #TaxReturnAdvice #TaxRefundIdeas #EarlyTaxPrep #SafeTaxDocuments #SmartRefundUses #PlanForNextTaxYear #anaecheverriassociates #TaxSeason2023 #EarlyTaxFiling #TaxRefundSeason #FinancialPlanning #TaxFraudProtection #TaxPreparation #IncomeTaxTips #TaxFilingDeadline #SecureYourRefund #anaecheverriandassociates #orlandotaxes #floridataxes

Ana Echeverri

Certified QuickBooks ProAdvisor

Ana can help you set up and manage your QuickBooks online and on desktop. Having a streamlined chart of accounts and strategy for accounting will help you understand your company's ins and outs.