From a legal approach, a sole proprietorship is a business entity that is not separate from the owner. But in a financial approach, you must separate your personal and business accounts.

This step seems so simple, but many individuals continue to intermingle their business and personal funds. That´s why I am interested to reinforce some concepts.

Often, we hear about mixing personal with business accounts. What´s the meaning of that? It means you need two bank accounts at least.

It might feel like opening up a bank account for your business will mean more admin work, but keeping your business funds and personal finances separated can save a lot of hassle when it comes to managing your money.

In my experience, I have 5 reasons to separate your personal and business accounts.

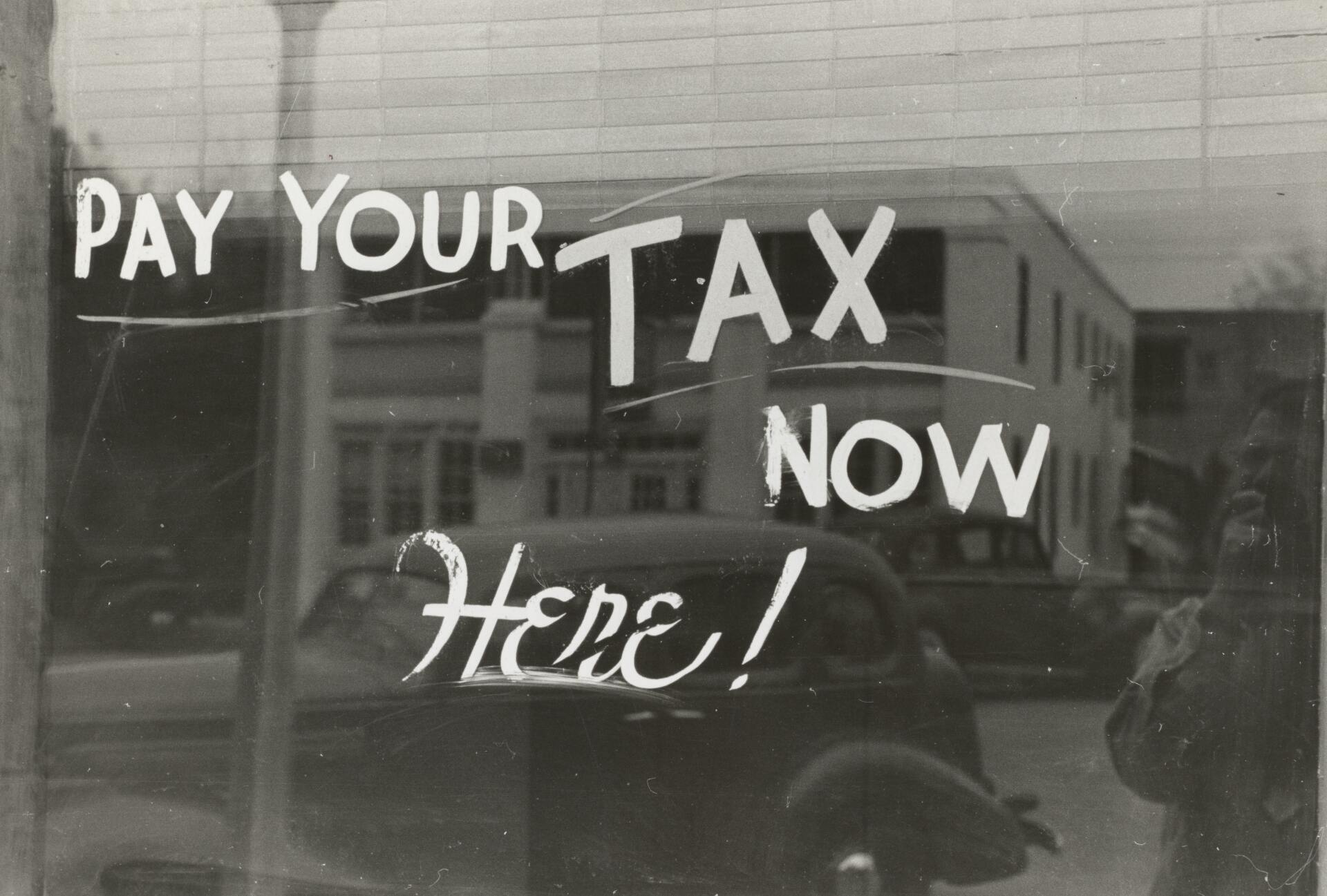

1. Effect on taxes. If you use your personal card to make business purchases, those expenses will not be reflected in your accounting. The expenses will be undervalued and utility overvalues, consequently, you will pay a higher tax than you should.

2. Cash flow. If you have separate accounts you can clearly see the flow of money. How much goes in, how much goes out and how much is really left.

3. Be prepared for an audit. An auditor will not take into account the expenses incurred from his personal accounts, or worse, he can take into account income reflected in his personal account as business income.

4. To request credits. To grow up the business you can use external financing, and you´ll need a clear financial history.

5. Avoid penalties. Clean and update information help you to calculate Sales taxes and estimated taxes. Planning your taxes you can save money by avoiding penalties.

Ana Echeverri

Certified QuickBooks ProAdvisor

Ana can help you set up and manage your QuickBooks online and on desktop. Having a streamlined chart of accounts and strategy for accounting will help you understand your company's ins and outs.