13550 Village Park Dr Suite 245, Orlando, FL 32837

IRS indicates, taxpayers should correct their return if they find that they should have claimed a different filing status or didn’t report some income. Taxpayers who claimed deductions or credits they shouldn’t have claimed or didn’t claim deductions or credits they could have claimed may need to file an amended return.

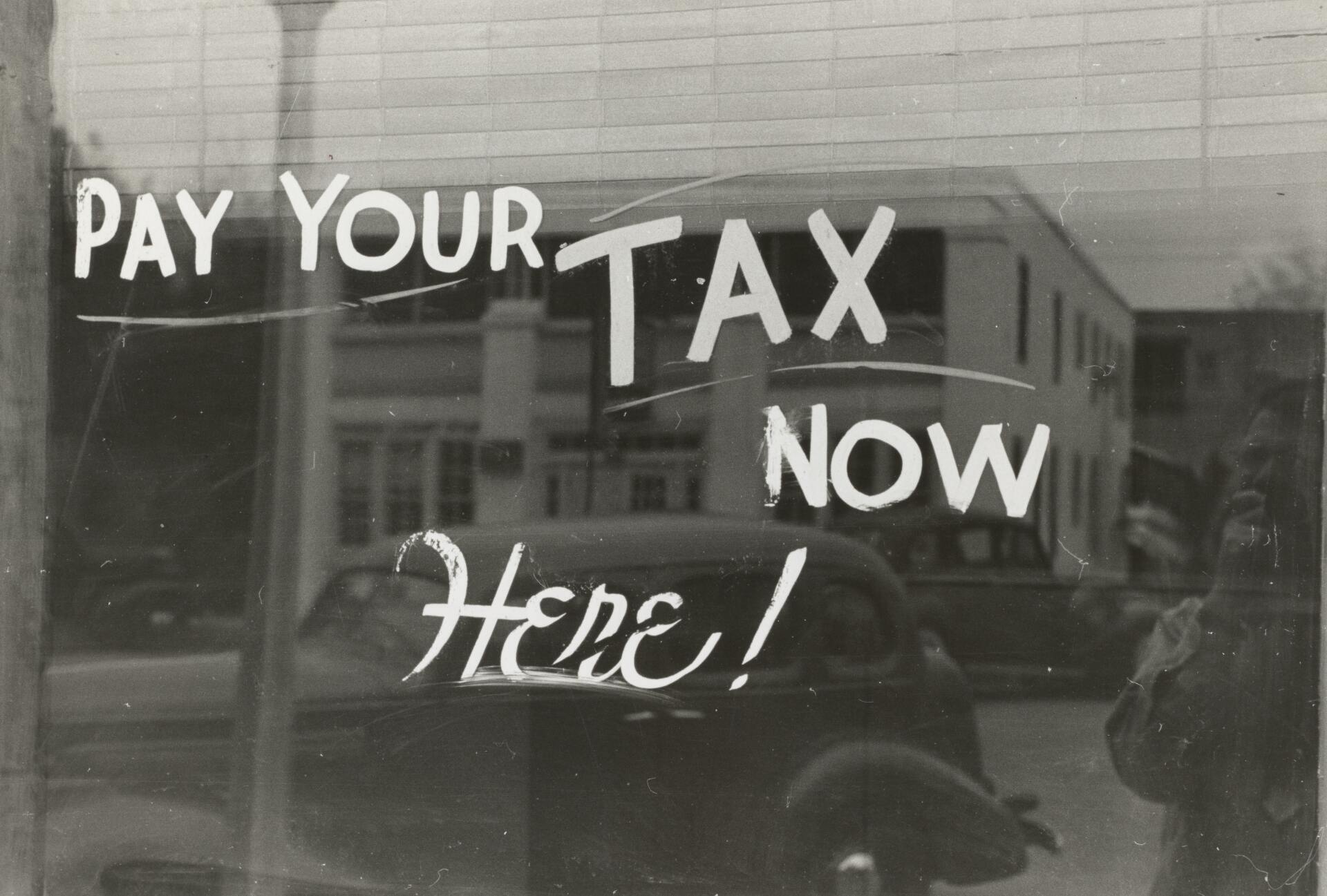

Do you need to correct something on your tax return for this year o past years?

We can help you. We can make an adjustment by filing an amended tax return, we can go back 3 years.

Call us and schedule an appointment.

Ana Echeverri

Certified QuickBooks ProAdvisor

Ana can help you set up and manage your QuickBooks online and on desktop. Having a streamlined chart of accounts and strategy for accounting will help you understand your company's ins and outs.

Stay up to date with the latest information for your business and individual needs

Join our mailing list!

Thank you for signing up!

We promise only to send you valuable information in a way that is simple to understand.

Please try again later